www.bankofamerica.com – How to Access Bank of America Card Online

Bank of America Card Login Guide :

At Bank of America, they have an unmistakable reason to help improve monetary lives through the force of each association. They satisfy this reason through their obligation to mindful development, which remembers a concentration for ecological, social, and administration authority.

Coordinated across their eight lines of business their ESG center mirrors their qualities, guarantees they are considering ourselves responsible presents a huge business opportunity and permits them to make imparted accomplishments to their customers and networks.

Why Choose Bank of America Card:

- Consistently, they give unrivaled accommodation in the United States, serving roughly 66 million purchasers and independent company customers.

- Bank of America is a worldwide pioneer in abundance the board, corporate, and venture banking, and exchanging across a wide scope of resource classes

- The organization serves customers through tasks across the United States, its regions, and in excess of 35 nations.

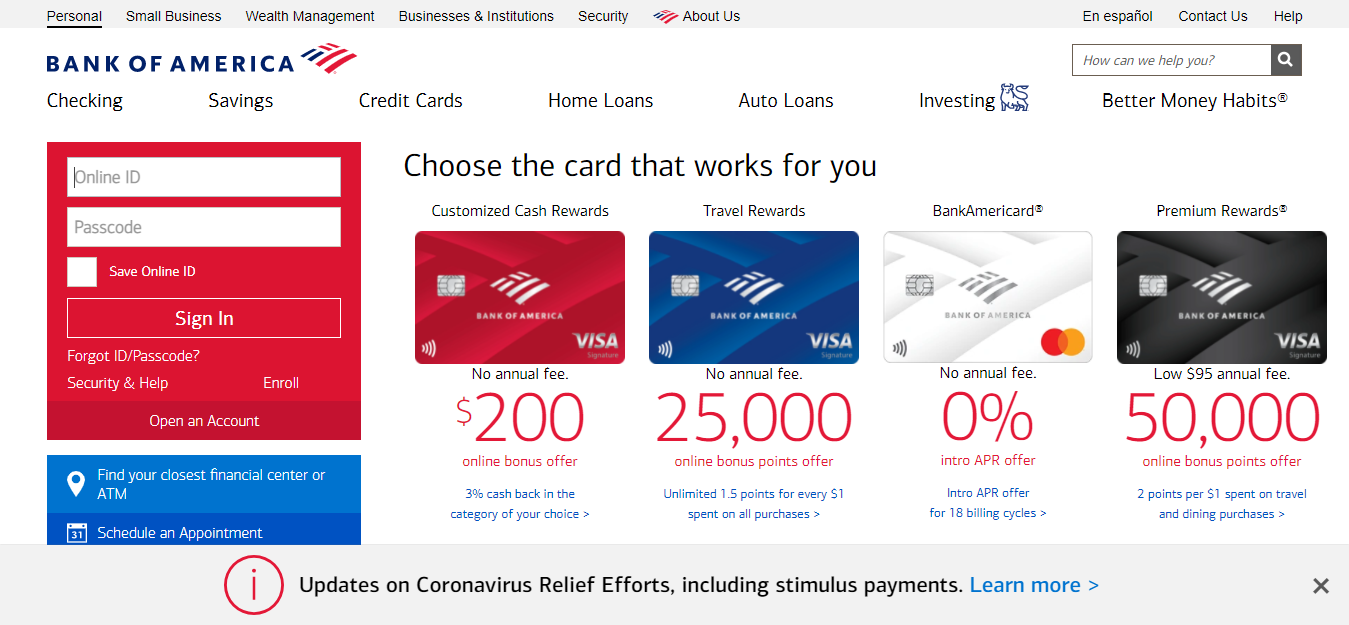

Bank of America Card Login:

- To login open the webpage www.bankofamerica.com

- After the page appears you will get the login widget at the center to enter your

- Online ID, password, click on the ‘Sign in’ button.

Reset Bank of America Card Login Details:

- If you want to reset the details open the page www.bankofamerica.com

- Once the page appears from the login widget click on the ‘Forgot ID/passcode’ button.

- On the next screen enter the card number, SSN, click on the ‘Continue’ button.

Enroll for Bank of America Card Account:

- To enroll in the account open the page www.bankofamerica.com

- After the page opens in the login homepage tap on the ‘Enroll’ button.

- In the next screen provide the card or account number, SSN or TIN, click on the ‘Continue’ button.

- If you do not have SSN or TIN, enter, checking or savings account number, ATM or debit card number, ATM debit card PIN. Click on the ‘Continue’ button.

Also Read : Access to Huntington Card Account

Steps to Stay Financially Fit from Bank of America:

- Comprehend Your Resources and Liabilities: The resources you own and the obligations or liabilities you have decide your total assets. Resources may incorporate money, reserve funds, stocks, securities, retirement accounts, land and whatever else of worth like vehicles or collectibles. Liabilities may incorporate a home loan, understudy loans, vehicle advances, charges due and Visa obligation.

- Survey Your Objectives: Once per year, consider your short-, medium-and long haul objectives. Are each still applicable? What amount do they cost? Is it true that you are on target to meet them? Some drawn out objectives, like going in retirement, may not change generously year to year. Momentary objectives, for example, taking care of a Visa bill, and medium-term objectives.

- Check Your Credit Report: Your credit report contains data about the situation with your credit accounts and your bill paying history. A decent FICO rating is basic to fitting the bill for advances at the most ideal rates. The Consumer Financial Protection Bureau suggests checking your report in any event once per year to ensure it is exceptional and right. Additionally, the CFPB proposes an additional check prior to applying for advances for enormous buys like vehicles and houses.

- Name Your Recipients: When you open a retirement record or purchase a protection strategy, you’ll most likely be approached to name a recipient—the individual who might gather from the record in case of your passing. Marriage, the introduction of youngsters, separation and demise can influence your decision. Ordinarily your companion is your default recipient, yet you additionally may wish to assign youngsters or another person.

- Deal with Your Duties: It’s critical to ensure you have sufficient put to the side to cover your expense bill a long time before the yearly cutoff time, for the most part April 15. The measure of government annual assessment you owe every year depends to some degree on your expense section, yet numerous elements influence it. Study personal assessment brackets.

Bank of America Customer Help:

To get further help call on toll-free number 1 (800) 432-1000.

Reference Link: