irs.gov – Pay Federal Taxes with Credit Card Online

Can You Pay Federal Taxes with Credit Card:

As indicated by the IRS, the normal citizen paid $15,322 in annual expenses in 2020. While numerous representatives have charges kept from their checks so they don’t need to pay everything in one single amount, you actually could owe some cash when duty time rolls around. Independently employed individuals, entrepreneurs, and consultants must be more independent with regards to getting sorted out their assessment installments.

Assuming you’re worrying over how you’ll pay your assessments next April, you may ponder: would you be able to pay government charges with a MasterCard?

Let’s take a look at this question and whether or not it’s a good idea.

The Cost of Paying Taxes with a Credit Card:

It’s critical to comprehend that it isn’t allowed to pay charges with a MasterCard, while there aren’t any extra expenses to paying your assessments utilizing a ledger move. This implies that you will be charged an expense that adds up to the level of your assessment installment.

The installment processor that you pick will decide the amount you are charged. The breakdown for the charges is as per the following:

- com: 1.96% charge, least $2.69

- com/took care of: 1.99% charge, least $2.50

- com: 1.87% charge, least $2.59

- The charges are significantly higher assuming you decide to utilize a coordinated IRS e-document and e-pay specialist co-op. This is the way much it costs from various suppliers:

- 1040.com: 2.35% charge, least $3.95

- com/Special Offers/TurboTax: 2.49% charge, least $3.95

- com: 3.93% charge, least $2

- It merits running the numbers and deciding if balancing these additional charges merits the comfort of utilizing a Visa to cover charges.

Pay Federal Taxes with Credit Card:

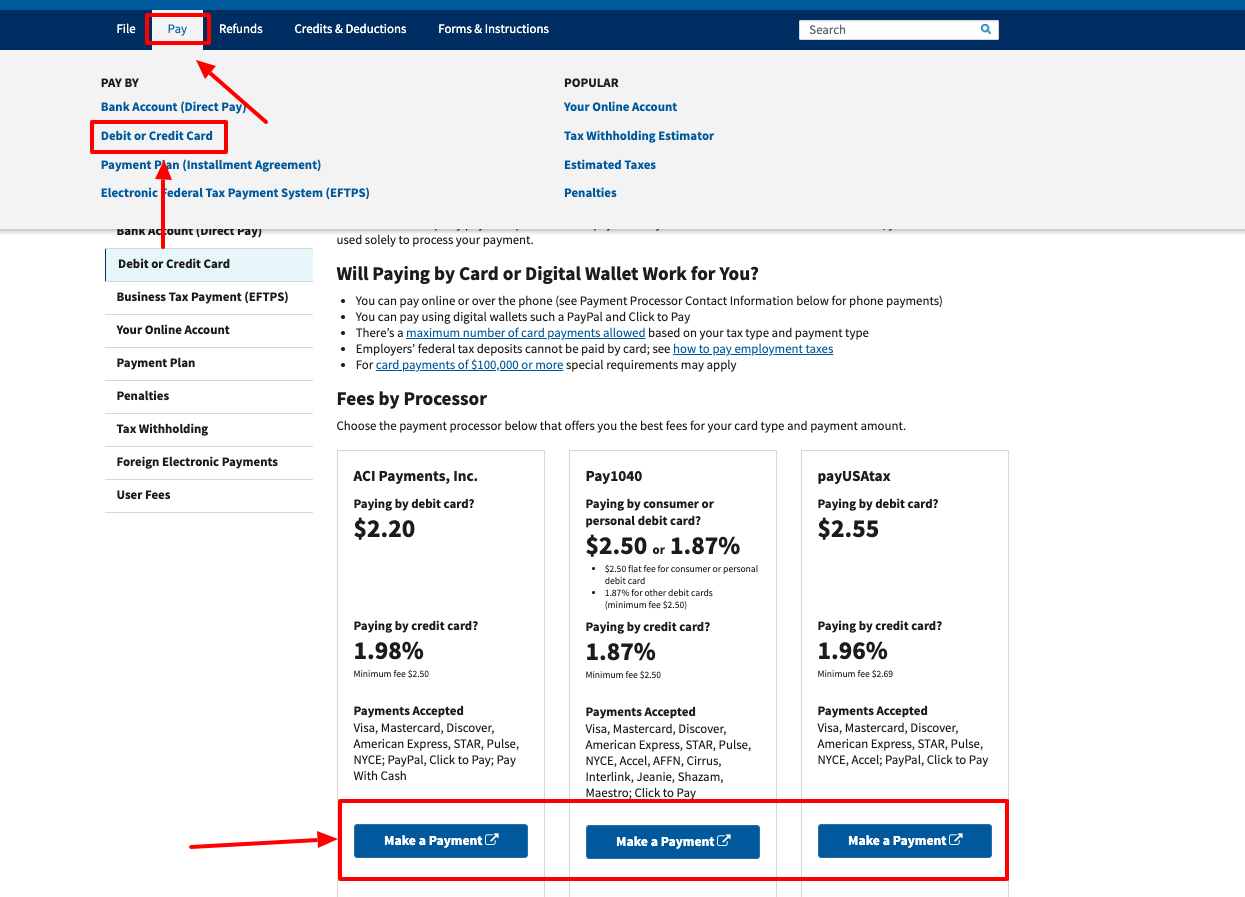

- You will get three payment options here. Mostly these payments go on with processors. You will get ACI payments, Pay 1040, and PayUSAtax.

- For ACI payments go to the website irs.gov

- Next at the top left side of the page click on the ‘Pay’ tab.

- From the drop-down click on the ‘Debit or credit card button.

- At the center of the page under ACI, payments click on the ‘Make a payment button.

- Choose the form you are paying the tax for and proceed with the payment.

- To pay by Pay 1040 click on the ‘Make a payment’ tab.

- Next choose whether it’s personal or business.

- For the personal click on the ‘Pay personal taxes’ button.

- Add the tax form number, choose the tax form option, the payment amount, choose the filing location. Now click on the ‘Next’ button.

- Now follow the page prompts to complete the payment.

- In case of payUSA tax click on the ‘Make Payment’ tab.

- Next at the center-left side choose from personal and business payments.

- For personal click on the ‘Make a personal payment’ button.

- You need to choose the payment category and click on the ‘Continue’ tab.

- Now follow the page instructions to complete the payment.

Federal Tax Payment Through Phone Number:

- Phone payment is also possible. Here too you can use your credit or debit cards.

- You have to call on these numbers.

- ACI Payment: 888-272-9829

- Pay1040 Payment: 888-729-1040

- payUSAtax Payment: 844-729-8298

Frequently Asked Questions on Federal Tax Payment:

- Will Paying by Digital Wallet or Card Work for You?

You can pay on the web or via telephone. You can pay utilizing computerized wallets such a PayPal and Click to Pay. There’s a greatest number of card installments permitted in light of your assessment type and installment type. Managers’ government charge stores can’t be paid via card; perceive how to make good on work charges. For card installments of $100,000 or more exceptional prerequisites might apply.

- What Cards are Accepted for the Payment?

Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE; PayPal, Click to Pay; Pay With Cash, Interlink, Jeanie, Shazam, Maestro.

- What Additional Information do You Need to Have Regarding the Payment?

No part of the card administration expense goes to IRS. You don’t have to send in a voucher assuming that you pay via card. Card handling charges are charge deductible for business charges. You should contact the card processor to drop a card installment. IRS will discount any excessive charge except if you owe an obligation for you. Your card explanation will list your installment as “US Treasury Tax Payment” and your charge as “Tax Payment Convenience Fee” or something almost identical.

IRS Contact Help:

For further help options, you can call on 877-754-4413.

Reference Link: