getmyoffer.capitalone.com – How To Get My Offer Capital One Promotion Program

Respond to the Capital One Mail Offer

Capital One Mail Offer

Capital One offers some of the most popular credit cards through the mail offers. The application process is quite simple. You will require your 16 digits of reservation number and the 6-digit access code. You will receive the reservation cove via mail, which was sent nationwide to the consumers with a good credit score. Capital One has been provided to be one of the best Credit Card companies in the market.

Through the years, several credit card companies have come and go. But Capital One has stood still in its positions. So, Capital One is one of the best credit card providers in the market.

How to Responses to Capital One Mail Offer

In the present days, Capital One attract their new customers via mail offers. They are the trusted bank and offers some of the grate credit cards. So, if you are thinking of purchasing a new credit card, then you should respond to the Capital One mail offer. You need to follow these instructions below:

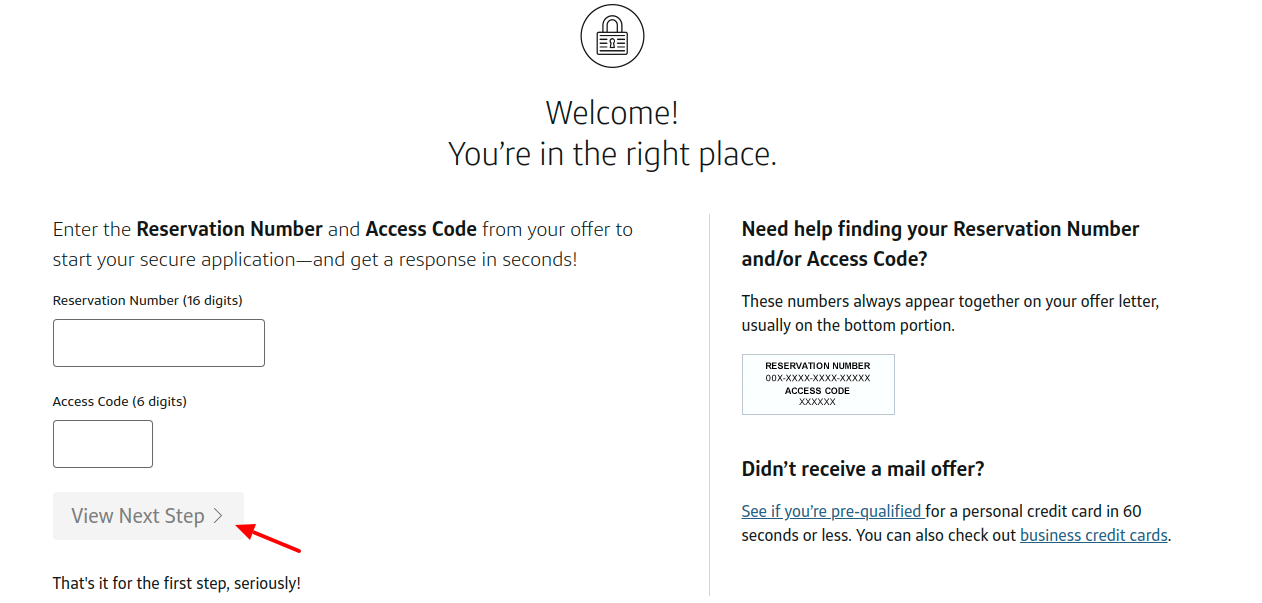

- First, you have to visit this link getmyoffer.capitalone.com.

- Then, you need to enter the 16 digits of Reservation Number and 6 digits of Access Code.

- After that, you need to click on the View Next Step.

- After that, follow the further steps to check if you are qualified or not.

Some of Best Credit Cards offered by Capital One

If the application is approved, then you might think about which Credit Card you should apply for. There are some of the best credit cards offered by Capital One:

- Best for Bad Credit: Capital One Secured Mastercard

If you want to build your credit score, then Secured Mastercard will be the perfect choice for you.

Benefits:

- This card does not charge any annual fee every year.

- Your card will help you to improve your credit line.

Rates and Fees:

Rates:

- APR for Purchase: The purchase APR of this card is 26.99%.

- APR for Cash Advance: For the Cash Advance, your APR will be 26.99%. It can vary on the market based prime rate.

Fees:

- Annual Fee: For this card, you don’t have to pay an annual fee every year.

- Transfer Fee: None.

- Cash Advance: For each cash advance, you take, you will be charged either $10 or 3% of the amount of each cash advance.

- Late Payment: For the late payment, you will be charged up to $39.

Apply: www.capitalone.com/credit-cards/secured-mastercard

- Best for Travel Rewards: Capital One Venture Rewards Credit Card

If you are looking for a travel reward credit card, then the Venture Rewards Credit Card will be a perfect choice.

Benefits:

- On spending of $3,000 on purchases within the 3 months, you will get to earn 50,000.

- On your purchases, you will get unlimited 2X miles per dollar.

Also Read : How to Apply Your Citi Love Double Cash Credit Card

Rates and Fees:

Rates:

- APR for Purchase: For the purchase, you will be charged 17.24%, 21.99%, or 24.49% based on creditworthiness.

- APR for Cash Advance: For the cash advance, your APR will be up to 24.49%.

Fees:

- Annual Fee: You will be charged up to $95 annually.

- Transfer Fee: For each balance transfer, you will be charged 3% of the amount of your transfer each time.

- Cash Advance: For the cash advance, you have to pay $10 or 3% of the amount of each cash advance.

- Late Payment: You will be charged up to $39 of late payment.

Apply: www.capitalone.com/credit-cards/venture

- Best for Cash Back: Capital One Quicksilver Cash Rewards Credit Card

If you are looking for the best cashback, then you can go with the Quicksilver Cash Reward Card.

Benefits:

- You can earn up to $150 cash bonus on the spending of $500 within the first 3 months.

- On your every purchase, you will get an unlimited 1.5% cashback.

Rates and Fees:

Rates:

- APR for Purchases: APR for purchases is 0% for the first 15 months. After the service period, your introductory APR will be 15.49%, 21.49%, or 25.49%.

- APR for Cash Advance: The APR for the cash advance will be 25.49% and can vary on the market based prime rate.

Fees:

- Annual Fee: For this card, you don’t have to pay an annual fee.

- Transfer Fee: For each transferred balance, you will be charged up to 3% of the amount.

- Late Payment Fee: You will be charged up to $39 as your late payment fees.

Apply: www.capitalone.com/credit-cards/quicksilver

- Best for Fair Credit: Capital One QuicksilverOne Cash Rewards Credit Card

Quicksilver One is another best credit card offered by Capital One. It comes with some of the best rewards.

Benefits:

- On every purchase, you will get a flat 1.5% cashback.

Rates and Fees:

Rates:

- APR for Purchase: For the purchase, the APR will be 22.99%.

- APR for Cash Advance: Your cash advance APR is 22.99% and can vary on market-based prime rate.

Fees:

- Annual Fee: The annual fee for this card is $39 annually.

- Transaction Fee: There is no transaction fee for this card.

- Cash Advance: For every cash advance you have to pay $10 or 3% of the amount of each cash advance.

- Late Payment Fee: For the late payment, you will be charged up to $39.

Apply: www.capitalone.com/credit-cards/quicksilverone

How to Activate Capital One Credit Card

- First, you need to visit verified.capitalone.com.

- Then, enter your username and password on the provided field.

- After that, simply click on the Sign-in button.

- Entering into the portal, you can easily activate your Capital One credit card.

How to Pay Capital One Credit Card Bill

Online Method:

You can make a payment online. To make the online payment, you have to visit this link verified.capitalone.com. After login into the portal, you can make the payment easily.

Pay by Mail:

Capital One

Attn: Payment Processing

PO Box 71083

Charlotte, NC 28272-1083

Capital One Credit Card Phone Number

Customer Support: 1-800-CAPITAL (1-800-227-4825)

Outside the US: 1-804-934-2001

Mail:

Capital One

Attn: General Correspondence

P.O. Box 30285

Salt Lake City, UT 84130-0287

Reference Link