How to Activate Your Citi Credit Card

Citi Bank’s Credit Cards are designed to be a great consumer-friendly financial card with loaded secured features. A large range of credit card categories is introduced keeping in mind the diverse requirements of the customers based on their financial spending, needs, credit score, preference, ability to maintain, and more. Just like its popularity, the activation process is relatively simple and easy compared to available credit cards in the market.

Citi Bank Credit Cards-Features and More

Citi Bank is ready with its great range of credit cards catering to every need. Customers are required to activate the Citi Credit Card themselves before starting to use it for online and offline purposes. No need to go through a tedious activation process. All the verification is completed before card approval. Here are some of the popular Citi Bank credit cards along with their elaborate features and rates.

Citi Rewards Credit Card

- Rounds up to nearly 10 points in almost every purchase.

- On spending a total of $1,000 on the first three months of account opening, earn up to 15,000 bonus points.

- Rewards Points of 2x on purchasing gas stations and supermarkets.

- Redeem points at everywhere Credit Card is accepted including BestBuy.com and Amazon.com.

- On redeeming fist 10,000 Thank You points, get up to 10% Points back.

- Earn 1 Reward Points from all other purchases.

- Redeem all your points on services like travel, flights, hotels, and more.

- Citi Entertainment giving you lifetime access to special presale events, concert tickets, lounge access, sporting events, dining, and more.

Rates and Fees

- Introductory APR of 0% within the first fifteen months of account opening.

- After that Variable APR Purchase rate and Balance, the Transfer rate becomes49% – 23.49%.

- Zero Annual Fees.

- Balance Transfer Fee is 3% or the amount of $5.

Citi Diamond Preferred Credit Card

- Unauthorized charges are $0.

- Citi Entertainment giving you lifetime access to special presale events, concert tickets, lounge access, sporting events, dining, and more.

- Avail Citi Identity Theft Solutions helping you to resolve any matter of identity theft helping you to get your life back on track.

- Great stability with one of the lowest APR out there.

Rates and Fees

- Low Intro APR for 18 months both on balance transfers and purchases.

- Zero Annual Fees.

- Post 18 months, variable APR will be 74% – 24.74%.

Citi Double Cash Card

- On eligible purchases, earn 2% It amounts to fixed unlimited 1% Cashback on buying an additional 1% on making payment for the purchase.

- Pay minimum dues on time and continue to enjoy your Cashback facility.

- Zero caps on Cashback earning and redeeming.

- No need to be responsible for unauthorized charges with $0 Liability.

- Avail Citi Digital Wallet.

- Contactless Payment

Rates and Fees

- 18 months0% APR from the date of the account opening.

- Post the time, it converts into 99% – 23.99%.

- No Annual Fees.

And loads more of them! Not to mention the merchant’s special exclusive credit cards. Simplify your finance and choose your card from the www.citibank.com

Activating Citi Credit Card Directly

Some of the credit cards require creating Citi Bank Online Banking Account first and then opting for the activation. Citi Bank Online Access and Activation can also be accessed from the Citi Mobile App (available for both Android and iOS). A few of the cards can also be activated directly from the Citi Bank web portal. In that case, you may have to register for offline transactions.

On obtaining the Credit Card, please look for the user manual. Check if you are required to activate the card directly or after creating an online account.

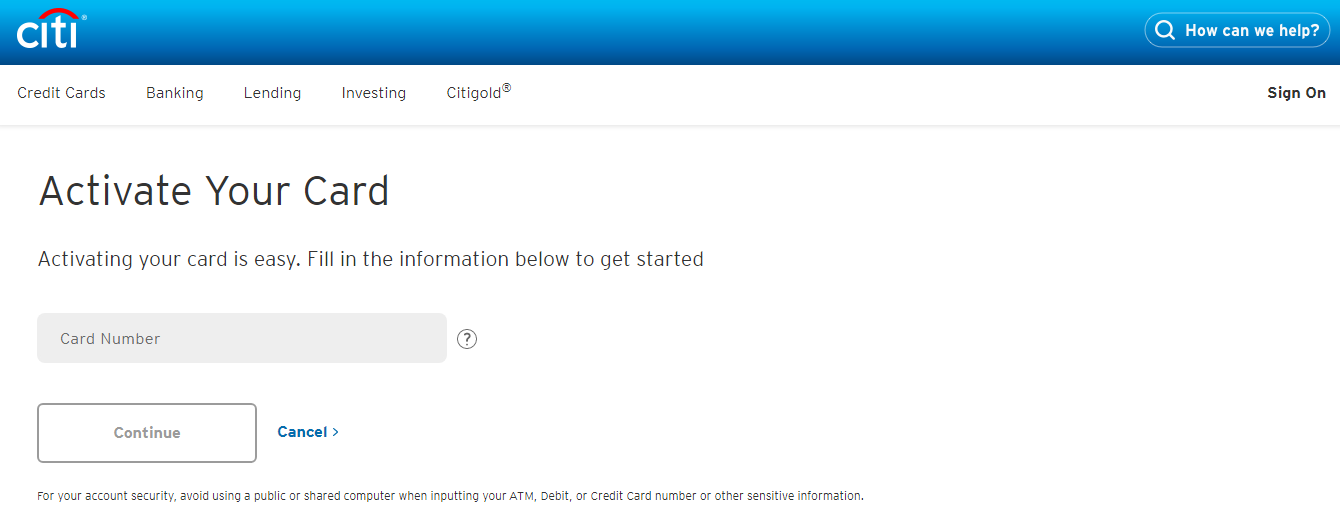

Check out the steps to activate the card without having to enroll in an Online banking Account:

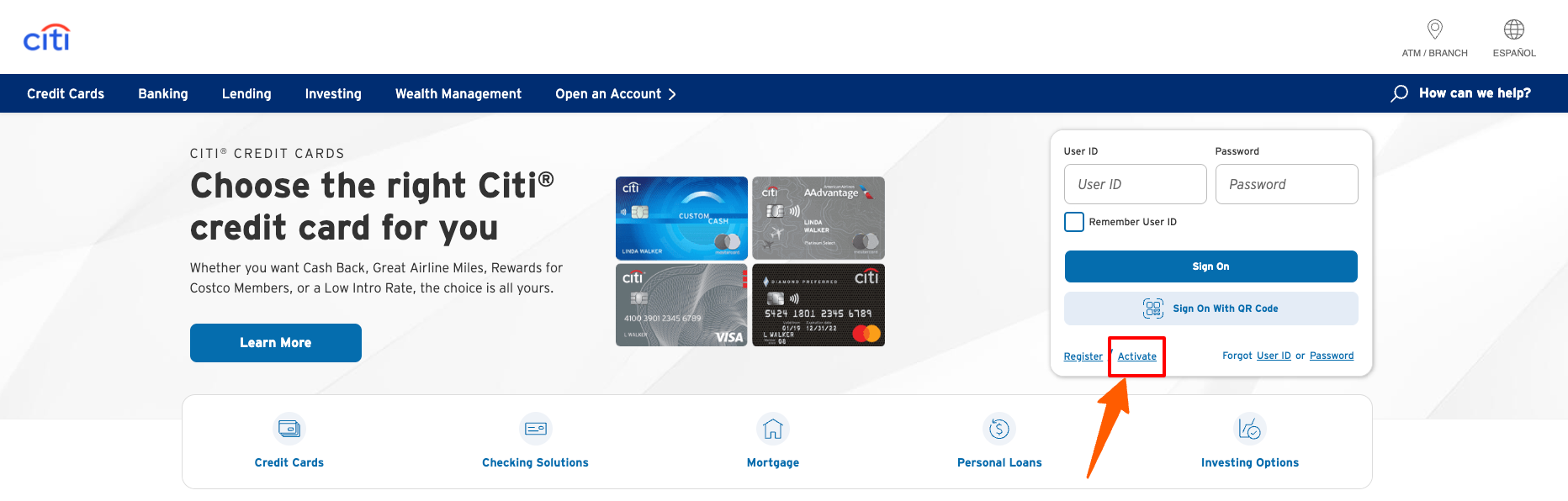

- Open your browser and visit www.citibank.com

- Select the Sign On option from the extreme top right page.

- Click on Activate

- Type in the Credit Card Number from the front portion of the card.

- Click on the Continue

- One by one enter the asked information about the primary cardholder:

- Credit Card Number.

- Social Security Number.

- Date of Birth.

- Card Expiry Date.

- Security Code.

- Name of the Primary Cardholder exactly as printed on the card.

- Follow the subsequent verification to proceed with the activation.

Online Banking Registration To Activate Card

Those Citi Bank Credit Cards requiring activation via Online Banking must first create Online Banking Account from the Citi Bank portal. Here’s how:

- Open your browser and visit www.citibank.com > Sign-On.

- Select Register for Online Access

- Proceed to the next step to enter the Credit Card number.

- On confirmation, please create a User ID and Password.

- Set up the Security Questions and Answers.

- Complete the account setup.

Also Read

How to Activate Merrick Bank Credit Card Online

Application Process For Surge MasterCard

Activate Citi Credit Card via Citi Mobile App

For App users:

- Download the Citi Bank mobile app from the Google Play Store or App Store.

- Log in to your Online Banking account using your User ID and Password.

- Tap on Activate Card to start the activation.

- A notification will be immediately sent to your registered email address and mobile number and your card status will be changed immediately.