Blue Cash Everyday Card from American Express Review

Avail American Express Cashback Rewards Program:

American Express has its Cashback Rewards Program on three different Visas. These cards acquire cashback on each buy you make. You will build cashback in your record in “Prize Dollars” until you reach $25, so, all in all, you can recover the Reward Dollars for an assertion credit. An assertion credit will be applied to your next bill, bringing down the sum you owe. So assuming you have $200 in charges on your MasterCard bill, and you reclaim $25 in cash back, you will just owe $175.Keep as a primary concern that there is a $25 least before you can recover your prizes.

You will build Reward Dollars in your record from the very first moment, yet you can’t really reclaim them until you have something like $25 developed. The Cashback cards from AMEX are showcased as procuring “cash back”, however they acquire Rewards Dollars. These Rewards Dollars can be recovered for proclamation credits, or for an assortment of gift vouchers, items and that’s only the tip of the iceberg.

American Express Cashback Rewards Program Cards:

- Cash Magnet (no annual fee)

- Blue Cash Preferred ($95 annual fee)

- Blue Cash Everyday (no annual fee)

Comparisons of the Three American Express Cashback Rewards Program Cards:

- Amex Cash Magnet: No Annual Fee. Cashback Rate is 1.5% on all purchases. Signup Bonus is $150 bonus cashback after spending $1000 in the first 3 months. Intro APR is 0% intro APR on purchases and balance transfers for the first 15 months. Rewards-wise, this card is perfect. 1.5% cashback is a good rate for a card with no annual fee.

- Amex Blue Cash Preferred: Annual Fee is $95. Cashback Rate is 6% on supermarkets and streaming services, 3% on gas and transit, 1% on everything else. Signup Bonus is $300 bonus cashback after spending $1,000 in the first 3 months. Intro APR is 0% intro APR for the first 12 months, on purchases and balance transfers. For simplicity, a card like the Cash Magnet may be better. Also, for those who want to earn more on groceries but don’t want to pay the annual fee, Blue Cash every day is a great option as well.

- Amex Blue Cash Everyday: No Annual Fee. Cashback Rate is 3% cashback on supermarkets, 2% cash back on gas & department stores, 1% on everything else. Signup Bonus is $200 bonus cash back after spending $1,000 in the first 3 months. Intro APR is 0% intro APR for 15 months on purchases and balance transfers. If you have a purchasing habit, the Preferred makes more sense as you will get enough to more than offset the annual fee. If you’re in a smaller household that spends less on groceries, the everyday makes more financial sense.

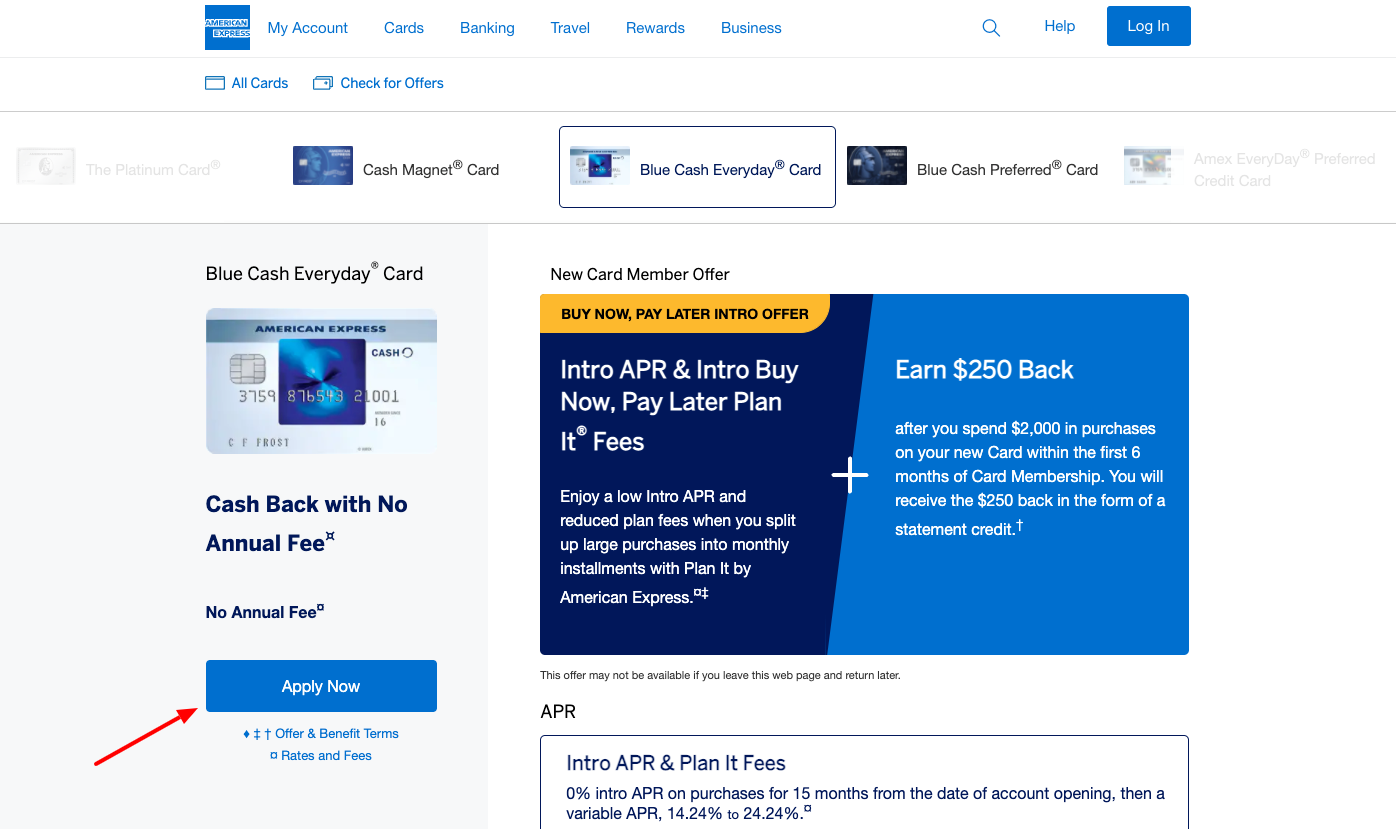

Apply for Amex Blue Cash Everyday:

- Go to the Amex Blue Cash every day official portal. This card is a cashback program card. americanexpress.com/us/credit-cards/card/blue-cash-everyday

- Click on the ‘Apply now’ button at the center-left side of the page.

- Provide your full name, first name, last name, email address, date of birth, mobile phone number, home address, home street address, apt, zip code, city, state, social security number, total annual income, nontaxable annual income (optional), income source

- Now click on the ‘Continue to terms’ button on the bottom left side.

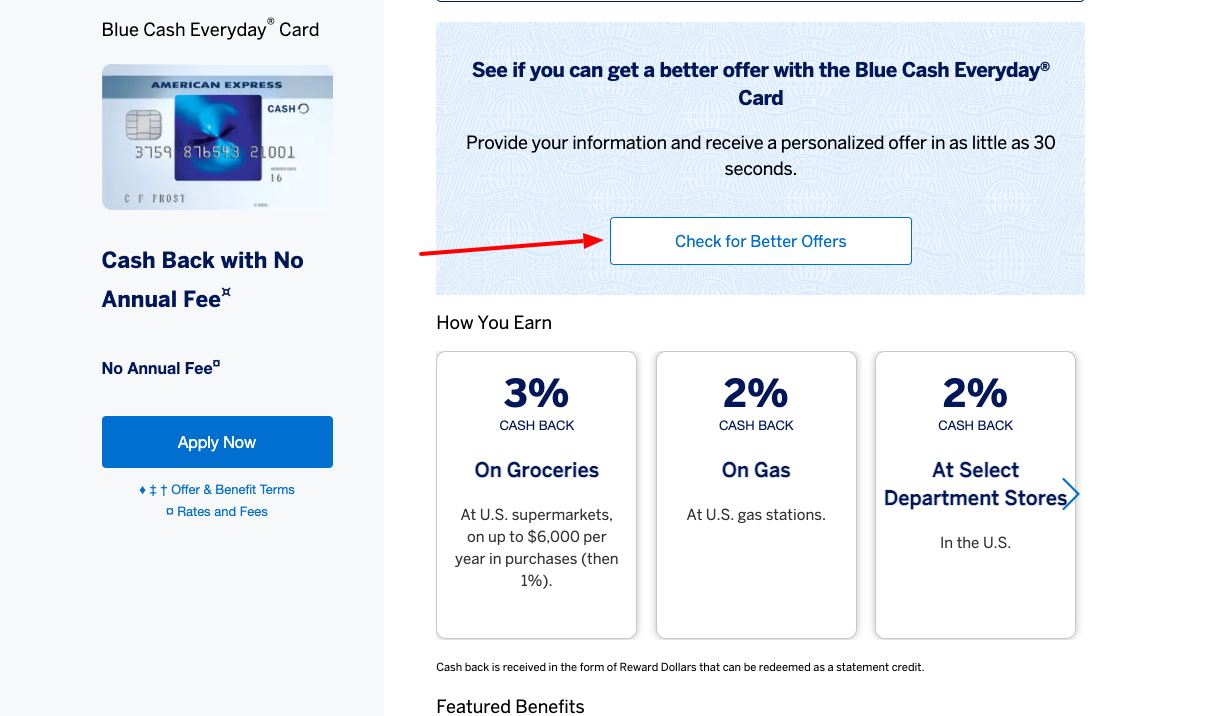

Pre-Qualify for Amex Blue Cash Everyday:

- Visit the Amex Blue Cash Everyday portal. The web address for the portal is americanexpress.com/us/credit-cards/card/blue-cash-everyday

- At the center-right side under the section ‘Check for Better Offers’ hit on the ‘Check for offers’ button.

- Add your first and last name, home street address, suite or apt, zip code, city, state, last 4 digits of your social security number, total annual income, nontaxable annual income.

- Click on the ‘View my card offers’ button on the bottom left side.

Activate Amex Blue Cash Everyday:

- For the card, activation use the URL americanexpress.com/us/credit-cards/card/blue-cash-everyday

- Log in with the online account for card activation.

- Then you can use the card.

Earning Amex Cashback Rewards:

- Earning Rewards Dollars is direct. Each buys you make on your MasterCard will procure Rewards Dollars. The rate at which you procure will rely upon which card you have, as well as the class of procurement.

- Whenever you take a gander at your financial records or your American Express web-based account, you’ll have the option to follow the number of Reward Dollars you have amassed, as well as the amount you procured on every exchange.

Also Read: How to Apply United Quest Mileage Plus Card Online

Redeeming Amex Cashback Rewards:

- Each of the three of the cards recorded above acquires a similar sort of remunerations: American Express “Prize Dollars”. When you collect $25 in Rewards Dollars, you can reclaim them for an assortment of remunerations:

- Cashback, as an assertion credit. This is frequently the most ideal choice

- Gift vouchers to many retailers, eateries from there, the sky is the limit.

- Select product from the Amex online prize store

- By and large, it seems OK to just recover for an assertion credit. This permits you to get the very thing you need with your prizes. For instance, to go a little overboard on a decent supper out, you can go to an extravagant eatery. On the off chance that you burn through $100, you can go in and reclaim your Rewards Dollars for assertion credit, lessening the sum you owe American Express for supper.

American Express Cashback vs. Membership Rewards:

- The Membership Rewards program is best for individuals who like to travel, and the people who like premium MasterCard advantages

- The Cashback Rewards program is best for individuals who like to keep things basic while expanding cashback on each buy.

Amex Cashback Rewards Review:

- Pros: Three cards to look over. Different cards with no yearly charge. Liberal prizes rates. Simple to reclaim for cashback. Cashback as proclamation credits can be utilized for pretty much anything

- Cons: You can recover awards in addition to $25. There are no movement recovery choices

Amex Blue Cash Every day Contact Information:

For further assistance call on the toll-free number 1-800-528-4800.

Reference Link:

americanexpress.com/us/credit-cards/card/blue-cash-everyday