www.mbna.co.uk – MBNA Credit Card Apply

How to Log In and Apply for an MBNA Credit Card :

Maryland Bank National Association is popularly abbreviated as MBNA was officially founded in the year 1982. Earlier it was a part of The Maryland National Bank. Presently, MBNA had its headquarters at Cawley House, Chester Business Park, Chester, England and is enlisted with the England & Wales under Company Enrollment No. 02783251. In the year 2017, MBNA joined the Lloyds Banking Group.

Since its establishment, MBNA Bank has worked for the people & community to grow and make their life simpler. All through the years, the bank has helped numerous customers with their getting daily requirements, from emergency times to unexpected bills payments. The organization in recent times also focused & cherishes a bit of advancement with a touch of modern technology as well. To serve the people of the country the organization utilized all the process that makes payment transfer fast & convenient, digital contactless payment deposits possible & multitasking smartphones applications.

The Bank has received numerous extraordinary industry honors over the years. From 2014 to 2019 MBNA has been selected for the Money Facts Consumer Credit Card Provider Award of the Year for the 6th consecutive time.

MBNA Credit Card Application:

Before applying for the MBNA Credit Card, you are required to complete the Eligibility Checker applications, and go through the Eligibility Requirements first:

MBNA Card Eligibility Criteria for Applying:

- You should be a permanent citizen of the United Kingdom (UK).

- Your age should be of 18 years or older, along with a normal annual salary.

- Required to provide a minimum 3 years old United Kingdom (UK) Residential Address history, a valid E-mail Address, & a Phone Number.

- Need to provide your Main Bank Account Number details & Sort Code.

- You must be free from any sort of Judgements of the County’s Court (CCJs), Individual Voluntary Arrangements (IVAs), or Insolvencies.

- Should not be an Unemployed or Student.

- Your MBNA Credit Card Eligibility has not been rejected within the last 30 days.

- Based on your present income the MBNA authorities will verify your previous & current Credit History, your Eligibility & the Affordability of a new card.

Apply for MBNA Credit Card:

If you want to apply for the Maryland Bank National Association (MBNA) Credit Card, follow the underneath guidelines:

- Open official page www.mbna.co.uk

- On the main home webpage of the MBNA site, click on the “Check Now” option.

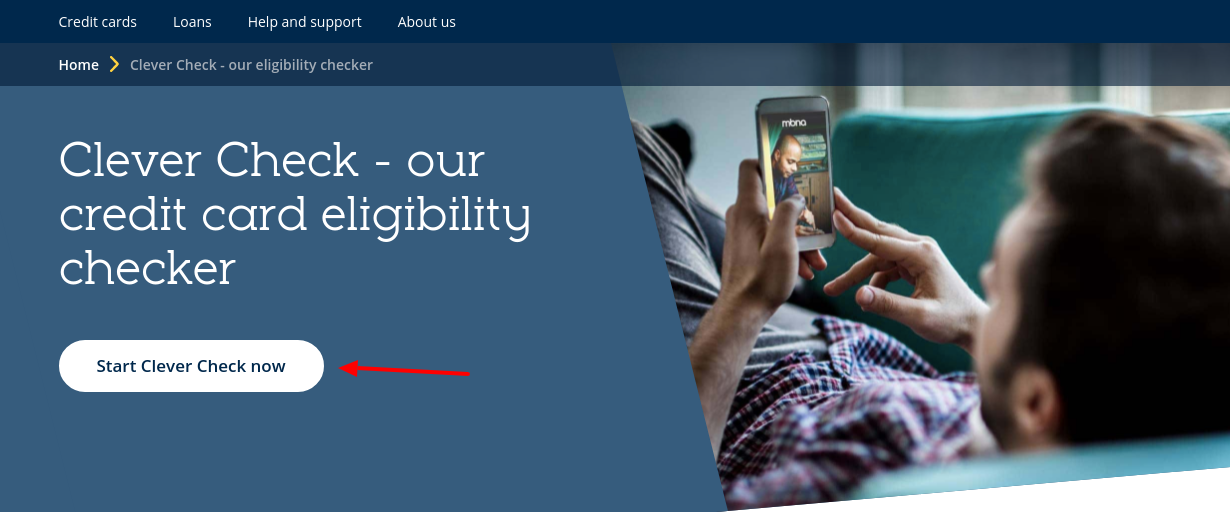

- Then on the next webpage, tap on the “Start Clever Check Now” bar.

- Now on another fresh page, primarily select your MBNA Credit Card, then put down your First Name, Middle Name, Last Name, Date of Birth (DOB), Gender, E-mail Address, again Confirm E-mail Address, UK Phone Number, Other Phone Number (Optional), Marital Status, Nationality (Select Country), etc.

- Also, you need to enter your information like Where You Live, Income and Employment, Spending and Expenses, Your Borrowing Options, etc.

- Now by tapping on the “CHECK ELIGIBILITY” button, you have to wait for the approval.

A Guideline for – How to Log In or Sign In for the MBNA Credit Card:

In order to get Sign In or Log In for the Maryland Bank National Association (MBNA) Credit Card Account, you can simply follow the steps below:

- Visit the main official website of MBNA, and get yourself Registered first.

- You can easily tap on the link given www.mbna.co.uk.

- Here on the landing page, tap on the “LOG IN” option on the top right side of the page.

- Referred to a new login page, you will find the “Welcome to Online Card Services” heading.

- Just under the head, enter your “Username” and “Password” credentials.

- Then, by tapping on the “Continue” button, follow through the on-screen guidelines to get access to your account.

Please Note: After you are approved by the MBNA Clever Check, you can easily apply for the Credit Card you are eligible for. Also, check the Credit Card Terms and Conditions along with the Rates and Interests applicable to your particular card.

Also Read : Wells Fargo Credit Card Apply

Register for the MBNA Credit Card:

It is quite easy to get Registered for the MBNA Credit Cards. You are just required to go through some exceptionally basic instructions to get Registered for the MBNA Credit Cards. You may confront a couple of issues, in the beginning. In that situation, go with the below steps to complete the application:

- On the landing page of the MBNA webpage, tap on the “Register” button.

- Now on the Registration page, you will find the “Welcome – Let’s Get Started” heading.

- Here you are required to put on your Title, First Name, Last Name, Date of Birth (DOB), Country (UK) Postcode, Credit Card Number (Optional – in case you have an Additional Card), etc.

- And lastly, by tapping on the “CONTINUE” button below, follow the on-screen guidelines.

A Guideline for – How to retrieve if you have forgotten your login details for the MBNA Credit Card:

On the Log In page of MBNA, you will find the option “Forgotten your Login Details”, by tapping on it you will be diverted to a new webpage. Here you will find 4 (four) options such as Change your Password, Change your Memorable Information, Change Both, and Find out your User Name, etc.

Now select the option as per your requirement, and tap on the “CONTINUE” button to follow the on-screen guidelines and provide the information as required to finish the process.

Various Credit Cards Offered by MBNA:

- MBNA Balance Transfer Credit Card

- MBNA Transfer and Purchase Credit Card

- MBNA Money Transfer Credit Cards

- MBNA Purchase Credit Card

MBNA – Contact Details:

MBNA Corporate Head Office Address:

MBNA Limited

Cawley House,

Chester Business Park, Chester CH4 9FB

To Make a Credit Card Payment (Mail To):

MBNA Limited

MBNA (180), P.O. Box – 274

Sheffield, S98 1RJ

Please Note: You must write Cheque to “MBNA Limited” and put down your Credit Card Number on the front part of the cheque (in the top left-hand corner), & remember to write your Name, Residential Address, and Phone Number on the back side of the cheque.

Phone Numbers:

Customer Care Service (Call): 03456 -062 -062 (For UK) (Mon – Thus 9 am – 8 pm, Fri 9 am – 6 pm, Sat 9 am – 1 pm)

Online Card Services (Call): 0345 -607 -2271 (7 am – 11 pm, 7 days a week)

Customer Care Service (Call): + 44 -1244 -659 -005 (From outside the UK) (7 am – 11 pm every day)

Citizens Advice Cell (Call): 03444 -111 -444

National Debt Line (Call): 0808 -808 -4000

Step Change (Call): 0300 -303 -2517

To Make a Balance or Money Transfer (Call): 03456 -062 -062 (For UK) (Monday to Friday 8 am – 10 pm, Saturday and Sunday 8 am -6 pm)

To Make a Balance or Money Transfer (Call): + 44 -1244 -659 -005 (For Outside the UK) (Monday to Friday 8 am – 10 pm, Saturday and Sunday 8 am -6 pm)

If You’re Experiencing Financial Difficulties (Call): 0800 -056 -7298 (For UK)

If You’re Experiencing Financial Difficulties (Call): + 44 -1244 -757 -233 (For Outside the UK)

For Hearing or Speech Impairment People (Call): 1 -8001 -03456 -062 -062 (Text Relay)

To Make Payment via Debit Card or Set up a Direct Debit (Call): 03456 -062 -062 (For UK) (Monday to Friday 8 am – 10 pm, Saturday and Sunday 8 am – 6 pm)

To Make Payment via Debit Card or Set up a Direct Debit (Call): + 44 -1244 -659 -005 (For Outside the UK) (Monday to Friday 8 am – 10 pm, Saturday and Sunday 8 am -6 pm)

Reference Link: